Click Calculate the button on the bottom part. 067 to 333 of total gross salary for employers that employ more than nine employees the precise rate depends on the business sector.

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

The International Labour Organization estimated in 2019 that there were 169 million international migrants worldwide.

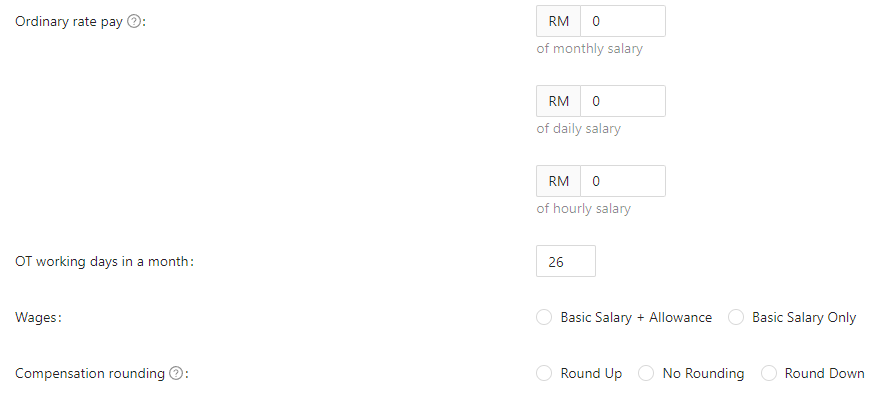

. 10000 has to pay his tax in advance by the due dates prescribed in this regard. In practice a flat rate of 167 is applied in respect of foreign employers. Navigate market uncertainty with validated always-on compensation data from multiple sources delivered transparently through our trusted data platform.

The industriallabour-law enacted by the British was meant primarily to protect the British employers interests. An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Short title and application 1 This Act may be cited as the Employment Act 1955.

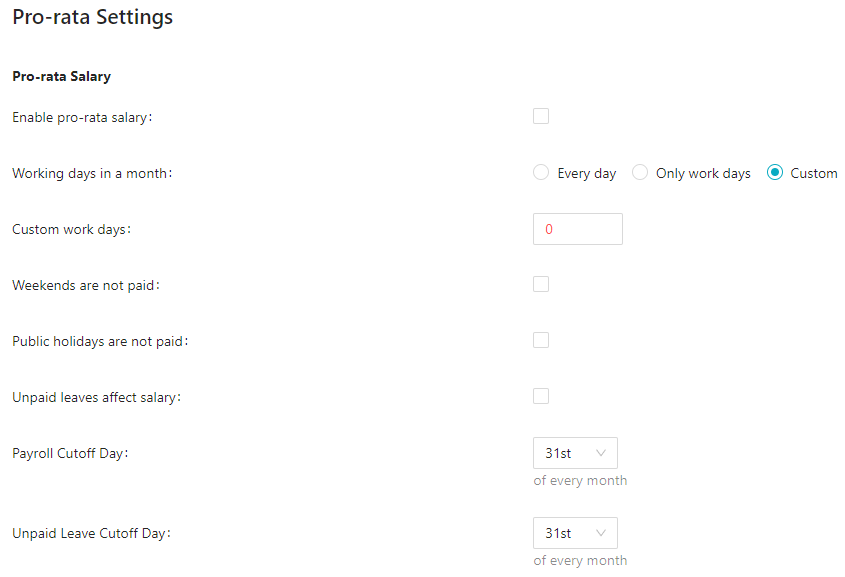

Find the number of working days in the current month. The former remains to be the foundation of Chinas employment laws while the latter allowed for the improved implementation of the labor principles contained in the 1995 Labor Law. Structuring Labour Law in many countries shows first of all that the laws themselves are reasonable but secondly that compliance with the law is the real issue.

Screengrab of MADLSA Qatars online calculator for end of service gratuity End of service gratuity according to Labor Law. 10000 shall pay his tax in advance in the form of advance tax. 245 of total gross salary.

By structuring wages online new minimum wages sooner become law. 167 of total gross salary for employers that employ up to nine employees. The minimum premiums are set at 35 of the normal pay for overtime work during daylight and 70 for work at nighttime.

As a result of the lack of efficient and effective means of implementing the 1995 China Labor Law the 2008 China Labor Contract Law was enacted. The labour and employment law in India is also known as Industrial law. Migrant workers who work outside their home country are also called foreign workersThey may also be called expatriates or guest workers especially when they have been sent for or invited to work in the host country before leaving the home country.

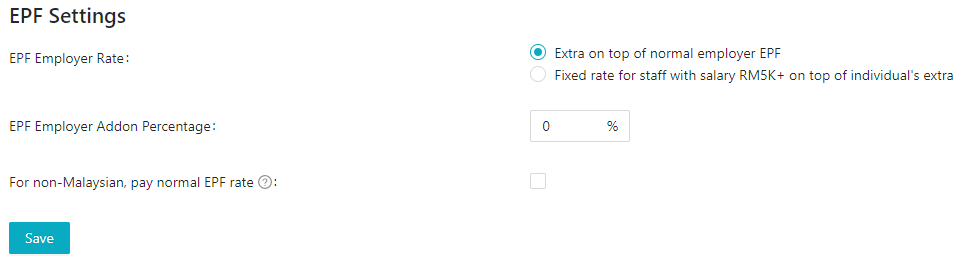

Tax rate between 008 and 02 applicable to the taxable value as per the specific table provided by the law for individuals and the value resulted from the evaluation report for legal entities. Income Tax - As per section 208 every person whose estimated tax liability for the year exceeds Rs. According to Qatar Labor Law Article 54 of Law No.

Manual calculation of unpaid leave. Considerations of the British. The building tax calculation method differentiates between buildings depending on their destination usage.

Multiply this number by the total days of unpaid leave. If the employee has completed less than four weeks service the same basis for calculation can be relied on for a preceding period of one two or three weeks. Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. In India the history of labour law is interwoven with the history of British colonialism. Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020.

1st June 1957 PART I - PRELIMINARY. Thus any taxpayer whose estimated tax liability for the year exceeds Rs. An Act relating to employment.

There are virtually millions of. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. 100 for work performed on days off and holidays.

Evolution of Labour Law in India. The calculation is made by identifying the total number of hours the employee has actually worked over the preceding four weeks and dividing the result by four. Therefore WageIndicator offers compliance forms mediation a legal help desk and even a mobile judge.

Input the number of payable days per year minimum of three weeks or 21 days as per the law. The minimum obligatory annual increase is set at no less than 7 of the basic salary which is the basis for calculation of social insurance. Effective from January 2020 resident individuals who earn more than 2 million annually will be taxed at 30.

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

.png)

All About Basic Salary Wage In Malaysia

Salary Calculation Dna Hr Capital Sdn Bhd

How Should You Calculate Pay For International Remote Workers Eca International

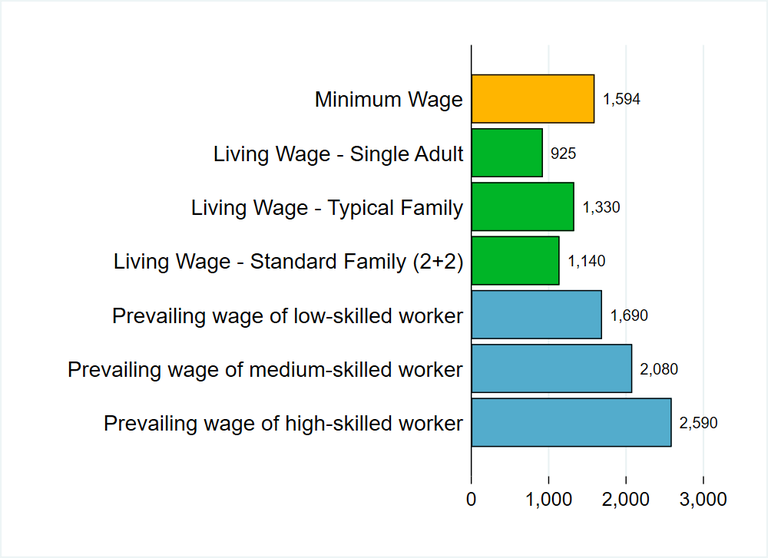

Archive Living Wage Series Belgium September 2019 In Euro Per Month Wageindicator Org

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Compensation System Wacker Chemie Ag

Minimum Wages Order 2022 Gazetted Donovan Ho

Best Payroll And Tax Services In Switzerland

Employment Act 1955 Salary Calculations And Benefits Marm